The Challenge: Tackling Manual, Risky, and Inconsistent Compliance Reviews

If you’ve ever worked in financial advice in New Zealand or Australia, you know how tricky compliance can be. Staying on top of regulations like the Financial Markets Conduct Act (FMCA) and the Code of Conduct isn’t just important—it’s essential. But traditionally, reviewing financial advice files is a slow, manual process, and that creates all sorts of headaches.

Here’s what teams were running into:

It takes forever: Manual reviews can eat up hours of someone’s day. It’s repetitive and drains efficiency (and budgets).

Plenty of room for mistakes: Humans make errors, and when you’re reviewing complex documents over and over, inconsistencies creep in. Different teams interpret the same rules in different ways, so quality can vary a lot.

High stakes for getting it wrong: Missed compliance gaps aren’t just inconvenient—they’re dangerous. Firms risk penalties, reputational damage, and sometimes the problems only show up after the fact, when it’s too late.

Scaling is tough: As more advisers join and business grows, the manual review system just can’t keep up. The bottleneck gets worse, and so do the risks and costs.

The big question: Could there be a smarter, more consistent way to handle all these reviews? The mission was clear—build a system to automate these complex checks, apply rules the same way every time, and make everything scalable and traceable.

The Solution: Building an AI-Driven Platform for Compliance

Why AWS and an AWS-Native Architecture?

We chose AWS as the backbone for our platform because it delivers what financial services demand: scalability, top-notch security, and strict compliance with data privacy rules. With AWS’s regional hosting, we can keep sensitive data close to home—in our case, Sydney—which means aligning with the NZ and AU privacy laws is straightforward. The AWS-native architecture also allows us to tap into robust tools for monitoring, auditing, and encryption right out of the box, making it easier to maintain transparency and protect client data. Plus, as our customer base grows, AWS gives us the flexibility to scale up smoothly without compromising performance or security.

To tackle the challenge, the team built an AI-powered B2B SaaS platform designed specifically for automated, standardized compliance reviews. They wanted something that was not only secure and accurate but also easy for compliance officers to use—no coding background required.

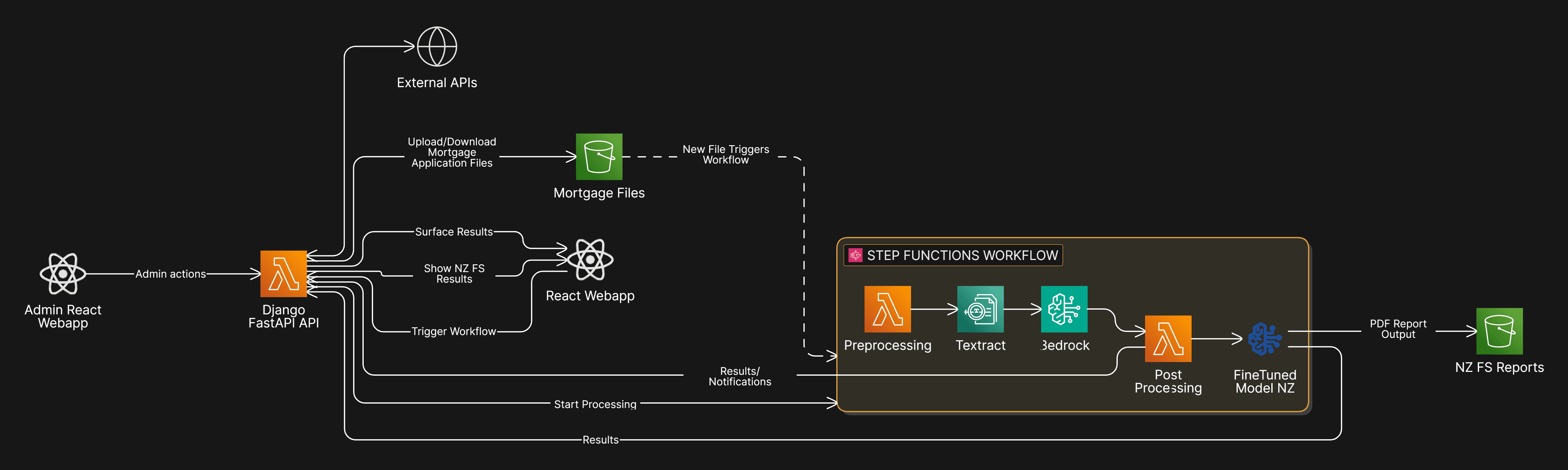

Technical Approach and Architecture

At the core, the platform runs on AWS-native infrastructure and is hosted in Sydney (so, yes, privacy and data security boxes are ticked for NZ and AU data rules). The architecture is modern and built for scale, so it can handle growth and keep data safe.

Here’s a peek under the hood:

Cloud: Amazon Web Services (AWS)

AI/ML Engine: Amazon Bedrock (using Claude Sonnet)

Database: MongoDB Atlas

Backend: FastAPI

Data Storage: Amazon S3

ML Model Hosting: Amazon SageMaker

Workflow Orchestration: AWS Step Functions

Frontend: React

How does it work for compliance teams?

Upload: You start by uploading advice documents—anything from mortgage files to investment recommendations.

AI analysis: The platform reads and evaluates each file instantly. Powered by Amazon Bedrock and custom models, it checks everything against FMCA and Code of Conduct requirements. Data privacy is always protected: the AI doesn’t use your client data for model training.

Risk flagging and reports: Any compliance risks get flagged, and users get a clear explanation of what’s wrong and where in the document it came from. Everything is transparent, so you can see exactly how the model arrived at its results.

Easy customization: Firms can tweak the rule engine so it matches their own internal policies—not just the general regulations.

Dashboards and audit trails: Compliance officers get an easy-to-use dashboard with a full audit trail, insights for teams, and a searchable file history for governance and reporting.

Security is built into every layer—with NZISM-compliant logging, encryption, and data separation—because handling sensitive client information demands nothing less.

The Outcome: Greater Accuracy, Efficiency, and Room to Grow

So, what’s changed since rolling out the platform? Quite a lot. Financial advice providers in the pilot saw big, measurable benefits.

What the results look like:

More accurate reviews: In tests with two large mortgage groups, the AI platform matched manual review findings more than 90% of the time—impressive and reliable.

Faster processing: Over 200 advice files ran through the platform in the pilot phase. Each review now takes minutes instead of hours, freeing up compliance teams for higher-level work like risk management and coaching advisers.

Market momentum: Larger financial advice firms took notice, which validated that the solution really does address the compliance challenge and is ready for broader adoption.

Why this matters for business:

Automating the compliance review process isn’t just about saving time. It lowers the risk of costly penalties, helps protect reputation, and gives firms the ability to scale without bottlenecks. The monthly licensing and pay-as-you-go pricing means costs grow only when the business does, making planning simple.

After making a splash in the mortgage advice world, the plan is to keep expanding—next stops include insurance, superannuation, and investment advice. It’s a solution made for the realities and regulations of the sector, with the agility to go even further.

If you’re curious about how modern tech can really make a business difference in compliance, this case is a clear example of what’s possible.

The Result in Their Words

"Easycoder took the time to understand our objectives, constraints, and compliance obligations. The solution they delivered was thoughtful, reliable, and immediately made sense for our business. We have no hesitation recommending them.”

— Uddhav K , CEO, AVCA